Tuesday, September 10, 2013

Multiculturalism damages a London house

By Rachel Johnson

It wasn't exactly the perfect end to the perfect summer. First up, on Monday, I became horribly snagged in the Notting Hill Carnival on the way back from Somerset.

I had a Boris Bike with me, which was the only means of transport available from Paddington Station to my residence in the epicentre of the million-man event.

I therefore formed a major roadblock for the bump-and-grinding crowds trying to surge past me in the wake of floats containing gyrating almost-naked women in skimpy glittery costumes and feather headdresses, and I ended up being rescued from the terrifying crush by a handsome young policeman called Matt Turner, to whom I owe my thanks.

That was Monday.

And so we come to 4am on Wednesday. We were all sleeping soundly in our beds when, less than 36 hours after I’d been almost suffocated by drunken twerkers (I should explain ‘twerking’ at this point: it’s a semi-pornographic, hip-thrusting dance move as performed by singer Miley Cyrus at an MTV awards ceremony last week), and thousands of revellers loaded to the eyeballs on Red Stripe and laughing gas, there was an almighty crash and the whole house shook.

My husband jack-rabbited out of bed and rushed downstairs. Neighbours apparently came out of their houses. I lay prone, putting off the delivery of more bad news.

It didn’t take long. ‘I thought it was a massive burglar, driving a tank into the house, or a bomb. But it’s the sitting room ceiling. It’s all fallen down.’

Was this because the whole house had been shaken non-stop for two days by the carnival’s massive sound systems?

My husband, mindful of the fact that the sitting room is where I claim to work, and where we keep the baffling new digital hi-fi, my laptop, my mother’s paintings and all my papers and books said: ‘Don’t go downstairs now.’

When I did brave it in the morning, it really did look as if a bomb had detonated. The room was draped in rubble, and a filthy, black, chalky dust cloaked the house.

The sofa, an ancestral footstool, a spindly side table, the carpets, were all ruined or destroyed, and my husband was on the telephone to Saga, our insurers. I could hear him saying: ‘But what do you mean? But I have up-to-date, comprehensive, contents AND and buildings insurance!’

It was not a good day.

Most of the rubble has been cleared, but we are all still in post-traumatic shock. My cleaner will not enter the premises without wearing a bike helmet to protect her bonce from further skyfall. And my daughter hasn’t been able to sleep, so worried is she that her ceiling will fall down on top of her in the night.

So my children lie sleepless, and home no longer feels safe as houses. And what happened – just like insurers disclaiming any liability, and invoking the small print – wasn’t even that uncommon.

More accidents happen at home than anywhere else, most commonly in the sitting room. (Some 113 of them involved ceilings, according to the latest yearly figs from RoSPA, the prevention of accidents people).

But still, we think of our homes as our refuges in which we nest and cocoon in security. We do not worry about our ceilings falling in and killing us (it was a miracle no one was slobbing on the sofa at the time).

And if the worst happens, we fools assume that our expensive insurance policies will protect us. But they don’t. The loss adjuster has just confirmed we are not covered for ‘wear and tear’ and not covered for ‘accidents’ and therefore, you guessed, not covered at all.

Which is outrageous. How do you carry out due maintenance on a ceiling that appears perfectly sound?

Which, for 48 hours, formed part of the fabric of a delicate, Victorian house, that was throbbing and pulsating to the ear-splitting decibels of the carnival, to the pimped-up sound systems called things like Far Too Loud and Rampage? Could that not have helped dislodged the lath and plaster?

I will be making these points with firmness as we appeal the decision from Saga/Zurich that we’re on our own, despite an unblemished no-claims record to date (apart from that time my husband got back from playing golf, and perhaps a visit to the 19th hole, and left his clubs on the pavement by mistake).

It’s a shocker. When your house falls down, who you gonna call? Not your insurers, that’s for sure.

SOURCE

Chris Brand comments:

Dainty Lady editress Rachel Johnson, the sister of Tory celeb and elected Mayor of London ‘BoJo,’ had the ceiling of her Victorian townhouse brought down by the throbbing and pulsating ‘music’ allowed to Blacks for their annual Notting Hill Carnival – a multiculti lesson from which she and her doubtless ‘anti-racist’ brother would hopefully profit. And, no, Rachel’s insurers refused to cover this ‘accident’ arranged by Britain’s diversity-loving, Black-deferential authorities.

Women can't do it all, says Burberry chief executive Angela Ahrendts

Angela Ahrendts, one of Britain's most successful businesswomen, has admitted that women "can't do it all", adding fresh fuel to the debate about whether women can combine harmony in the home with business success.

Mother of three teenagers, Ms Ahrendts is credited with reviving the fortunes of Burberry, the fashion brand where she is chief executive, and establishing herself as one of the most astute in the sparse ranks of female bosses.

Does she achieve a balance that suits the family as well as shareholders? She thinks so but works hard at it.

Her working day starts at 4.35am, but she rations out-of-hours work to one evening a week and insists on arriving home on Friday after travelling.

She has turned down invites to the Oscars because: "It's not more important than my husband. It's not more important than my kids. It's not more important than Burberry".

She said in an interview with The Sunday Times: “I don’t want to be a great executive without being a great mum and a great wife. I don’t want to look back and say I wish I had done things differently. Balance is a really big word for me.

"It's one of the most important parts of my job, showing that you can't do it all."

Ms Ahrendts' comments are the latest in a debate led by Facebook chief operating officer Sheryl Sandberg. Ms Sandberg has called for working women to "lean in" to their careers and demand husbands bear a greater share of the domestic burden.

While both are American, they appear to have different takes on the issue.

Sandberg believes women are penalised at work because of gender stereotypes, one of the themes in her book ‘Lean In: Women, Work and the Will to Lead.”

She has said: “Give us a world where half our homes are run by men and half our institutions are run by women. I’m pretty sure that would be a better world. Our culture needs to find a robust image of female success that is first, not male and second, not a white woman on the phone, holding a crying baby.”

Ms Ahrendts says it is impossible to have it all. "I’m here to run Burberry and I’m here to be a really great wife to my husband. And we have three amazing teens so that’s three really big jobs,” she said.

She tries to lead by example. “We have a lot of women working here and I always tell them they are mothers first. Those children are their legacy and they have partners and that’s a big obligation.”

SOURCE

Criminal who burned woman's face can stay in Britain because of his human rights

A violent foreign criminal who burned a woman’s face with melted plastic and scalded her with boiling water has defeated a bid to deport him from Britain because of his human rights, the Telegraph can disclose.

Valentine Harverye, a Zimbabwean national, was jailed for five and a half years for grievous bodily harm after he “mutilated” and “humiliated” his 34 year-old victim, whom he scarred for life.

The Home Office tried to deport him under rules which say that any foreigner jailed for more than 12 months should be subject to automatic deportation but the 22 year-old brought a human rights appeal, and won.

Immigration judges ruled that Harverye could face “ill-treatment” if he was sent back to Zimbabwe, which would breach Article 3 of the European Convention on Human Rights.

The Government is proposing to change the law so that foreign criminals cannot overturn deportation by deploying some human rights arguments - but Article 3 will not be curtailed, meaning that Harverye would almost certainly win his case even under the new rules.

It emerged in Harverye’s case that his brother, Matthew, also overturned a deportation bid on human rights grounds last year after being convicted of common assault.

Priti Patel, a Conservative MP, said: “This is a shocking case and a dreadful example of how the courts have once again disregarded the rights of the victim over the rights of an appalling criminal.

“The sooner we can reform human rights legislation and get some sanity back into the law, the better.

“We all know the problems with the ‘right to family life’ that the Government has pledged to address. But we need to look at all aspects of human rights legislation.

“There are a core of offenders who have done their utmost to challenge the Government on human rights grounds and that needs to change.”

Harverye came to Britain in 1998 as a dependant of his mother, who had married a British citizen.

He received his first reprimand in 2004 for common assault, and was then convicted of a further 12 offences over the next five years.

The most serious was the assault on the 34 year-old woman which took place at her home in January 2009.

Richard Thatcher, who prosecuted the case at Nottingham Crown Court, said Harverye assaulted the woman - a prostitute - and appeared to find the incident funny.

In front of a group of five or six people, Harverye set fire to a plastic cider bottle and held it to the victim’s face and neck, before pouring scalding water into her knee-high boots.

“She ran screaming to the bathroom, no help was offered to her, she was made to return to the front room by the defendant and told to dance for all those present and strip,” Mr Thatcher said. “She danced for about a minute or so while in pain.”

Judge Dudley Bennett jailed Harverye, a drug dealer, for five and a half years, and described the crime as “horrific”. “In her own home you attacked her, you abused her, you mutilated her, you intimidated her and you humiliated her over a period of time,” the judge said. “She is scarred for life and has had to undergo surgery.

“You used a melted plastic bottle and stuck it in her neck. That is awful. And if that wasn’t enough you humiliated her by trying to get her to strip and dance in front of a group and you warned her not to go to the police and threatened her.”

When the Home Office tried to have Harverye deported he appealed and won, but the Home Office lodged and appeal and the case had to be heard again.

In July this year Upper Tribunal Judge Christopher Hanson ruled that Harverye faced a “real risk of ill-treatment sufficient to breach the high threshold of Article 3” if he were returned to Zimbabwe because he would be unable to demonstrate loyalty to Zanu-PF, the ruling party led by Robert Mugabe.

A Home Office spokesman said:"We are disappointed by the tribunal's decision as we firmly believe that foreign nationals who break the law should be deported. We are examining the detail of this ruling before we decide whether to appeal.”

SOURCE

U.S. groups oppose government-compelled, risky, race-conscious lending

To reduce the risk of another financial crisis, and prevent the government from pressuring banks and mortgage companies to engage in risky, race-conscious lending, the Competitive Enterprise Institute recently joined in an amicus brief filed by the Pacific Legal Foundation in a pending Supreme Court case, Township of Mount Holly v. Mt. Holly Gardens Citizens in Action, Inc. The question presented is whether race-conscious “disparate-impact” causes of action can be read into laws, like the Fair Housing Act, that ban racial discrimination, by government agencies, thus effectively turning the colorblind intentions of such laws upside down.

“Disparate impact” is when a neutral policy happens to impact more minorities than whites, like a standardized test that whites pass at a higher rate than some minority group, even though test scores are calculated the same way for members of all races. The Supreme Court sometimes declines to interpret anti-discrimination statutes as banning neutral practices that have a “disparate impact,” but in other cases, it interprets then as banning “disparate impact,” deferring to the statutory interpretation of civil-rights agencies, like the EEOC, that like “disparate impact” rules because they expand agencies’ power to regulate businesses and interfere with their race-neutral criteria for things like hiring, lending, or leasing apartments.

Banks have been under pressure from lawmakers and regulators to give loans to minorities with bad credit, in order to avoid liability for “racially disparate impact,” and to provide “affordable housing” and promote racial “diversity.” (For example, the Obama administration has ratcheted up such pressure, demanding that targeted banks make preferential loans to minorities with bad credit, notes Investor’s Business Daily, extracting such racial preferences in recent settlements with banks.) Such pressure played a key role in triggering the mortgage crisis, judging from a story in The New York Times. For example, “a high-ranking Democrat telephoned executives and screamed at them to purchase more loans from low-income borrowers, according to a Congressional source.” The executives of government-backed mortgage giants Fannie Mae and Freddie Mac “eventually yielded to those pressures, effectively wagering that if things got too bad, the government would bail them out.” (which in fact happened, at enormous expense to taxpayers).

Our amicus brief in the Mount Holly case points out that the legislative history and plain language of the Fair Housing Act does not support a disparate-impact cause of action, contrary to the Obama Administration’s claims. The brief was principally authored by the Pacific Legal Foundation, and co-authored by lawyers at the Competitive Enterprise Institute, the Center for Equal Opportunity, and the Cato Institute. As usual, Pacific Legal Foundation drafted a high-quality brief.

The brief contains arguments that I’ve previously raised, such as the fact that deferring to the Obama administration’s recent interpretation of the Fair Housing Act as including a “disparate impact” cause of action would violate a principle of statutory interpretation known as the canon of constitutional doubts. The Obama administration’s position also conflicts with the federalism canon of statutory construction set forth in the Supreme Court’s decision in United States v. Bass.

This is not the first Supreme Court case that raises this issue. An earlier case known as Magner v. Gallagher also did so, but the Obama administration paid off the challenger in that case (the City of Saint Paul, Minnesota) to get it to drop its challenge to race-conscious disparate impact rules, before the Supreme Court could rule on it. As we and the Wall Street Journal described earlier, the Obama administration declined to pursue a fraud claim worth up to $180 million against a city to get it to drop its pending Supreme Court challenge to a dubious interpretation of the Fair Housing Act that the Obama administration has used as a tool to get banks to adopt racial quotas in lending. In doing so, it ignored the objections of career Justice Department lawyers, and likely cost taxpayers tens of millions of dollars in a case of “particularly egregious” fraud.

CEI jointly filed an amicus brief in that case, Magner v. Gallagher, challenging the validity of “disparate impact” claims under the Fair Housing Act, and explaining how the administration was using the club of “disparate impact” lawsuits to force banks to use racial preferences.

“Disparate-impact” claims alleging “unintentional” discrimination are authorized in the workplace by the Civil Rights Act of 1964, but not in most other settings. The Supreme Court has rejected “disparate impact” claims in most other contexts, such as in contracts and schools, and under the Constitution’s equal protection clause. Despite court rulings casting doubt on this “disparate impact” theory outside the workplace, the Obama administration has paid liberal trial lawyers countless millions of dollars to settle baseless “disparate impact” lawsuits brought against government agencies by minority plaintiffs, even after federal judges have expressed skepticism about those very lawsuits, suggesting that they were meritless.

Obama’s first Assistant Attorney General for Civil Rights, Thomas Perez, argued that bankers who don’t make as many loans to blacks as whites (because they make lending decisions based on traditional lending criteria like credit scores, which tend to be higher among white applicants than black applicants) are engaged in a “form of discrimination and bigotry” as serious as “cross-burning.” Perez compared bankers to “Klansmen,” and extracted settlements from banks “setting aside prime-rate mortgages for low-income blacks and Hispanics with blemished credit,” treating welfare “as valid income in mortgage applications” and providing “favorable interest rates and down-payment assistance for minority borrowers with weak credit,” notes Investor’s Business Daily.

Fearing bad publicity from being accused of “racism”, banks have paid out millions in settlements after being sued by the Justice Department. A Michigan judge called one proposed settlement “extortion.” These settlements provide cash for “politically favored ‘community groups’ ” allied with the Obama administration, and a Wall Street Journal article predicts that “many” of the loans mandated by these settlements “will eventually go bad.”

The banks accused of “racism” by the Obama administration include banks that were previously praised by non-political government agencies for their success in minority outreach and lending to minorities in regions in which they did business. For example, the Obama administration is suing Cardinal Financial Corp., even though “the FDIC in the past gave kudos to Cardinal for its lending practices. Justice is now accusing Cardinal of failing to open branches and achieve racial loan quotas in counties that its federal regulator never before contended should be the focus of its lending,” arguing that it was not enough for the bank to make loans to minority applicants who applied for loans, and that it had an affirmative duty to open new branches in heavily black areas it had never done business in before.

The Obama administration’s demands suggest it learned nothing from the financial crisis, which was caused partly by “diversity” mandates and affordable housing mandates that encouraged lending to people with bad credit scores who later defaulted on their loans. Banks were under great pressure from liberal lawmakers to make loans to low-income and minority borrowers. For example, “a high-ranking Democrat telephoned executives and screamed at them to purchase more loans from low-income borrowers,” The New York Times noted.

More HERE

*************************

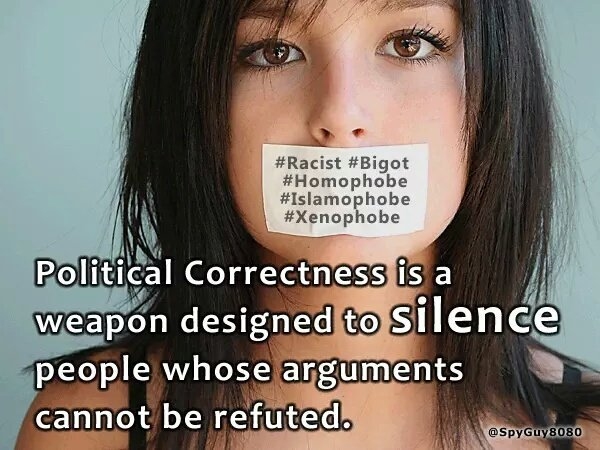

Political correctness is most pervasive in universities and colleges but I rarely report the incidents concerned here as I have a separate blog for educational matters.

American "liberals" often deny being Leftists and say that they are very different from the Communist rulers of other countries. The only real difference, however, is how much power they have. In America, their power is limited by democracy. To see what they WOULD be like with more power, look at where they ARE already very powerful: in America's educational system -- particularly in the universities and colleges. They show there the same respect for free-speech and political diversity that Stalin did: None. So look to the colleges to see what the whole country would be like if "liberals" had their way. It would be a dictatorship.

For more postings from me, see TONGUE-TIED, GREENIE WATCH, EDUCATION WATCH INTERNATIONAL, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS, DISSECTING LEFTISM, IMMIGRATION WATCH INTERNATIONAL. My Home Pages are here or here or here. Email me (John Ray) here.

***************************

Subscribe to:

Post Comments (Atom)

/>

/> Kristina Pimenova, once said to be the most beautiful girl in the world. Note blue eyes and blonde hair

Kristina Pimenova, once said to be the most beautiful girl in the world. Note blue eyes and blonde hair

Bliss: What every woman wants: to feel safe and secure in the arms of her man. Robert Irwin and Rorie Buckey. See

Bliss: What every woman wants: to feel safe and secure in the arms of her man. Robert Irwin and Rorie Buckey. See

No comments:

Post a Comment